China’s Outdoor Apparel Market: A Deep Dive into Unprecedented Growth

The outdoor apparel sector in China is experiencing explosive growth, outpacing even more established sports categories. Our recent China Outdoor Apparel Ecommerce Report uncovers what’s driving this surge, and what global brands need to know to stay competitive.

Below, we break down the key forces shaping the market.

Although outdoor apparel has a long-standing presence in China, the recent acceleration in growth is unprecedented. Consumers are increasingly focused on health and lifestyle, reframing outdoor activities as a desirable way of living.

Local brands have been quick to adapt, while global players are also benefitting by innovating with better products and more sophisticated marketing. Interestingly, the broad and inconsistent use of product tags shows that both brands and consumers are still in an education phase—where celebrity endorsements are helping define and elevate the category.

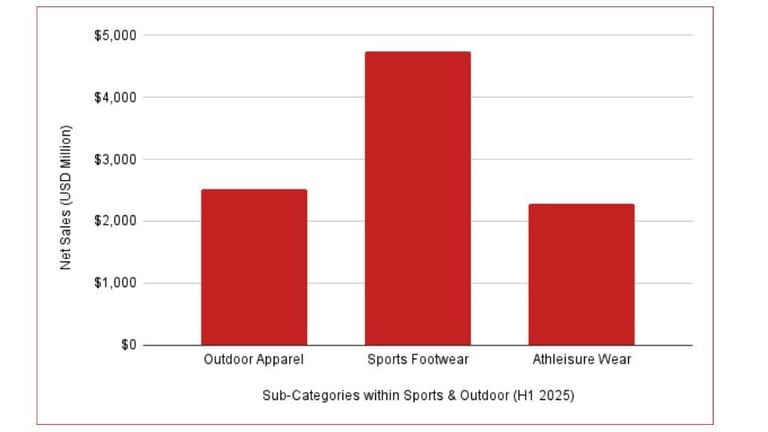

Image: Outdoor apparel net sales across Tmall, JD.com & Douyin grew by 26% in H1 2025 to reach $2.52bn, while sports footwear grew 4% to reach $4.73bn and athleisure wear grew 6% to reach $2.28bn

Data from our China Outdoor Apparel: 2024-25 Ecomm Report

2. A Product-Driven, Not Brand-Driven, Market

Our data shows that consumers are choosing outdoor apparel based on product performance rather than brand name. Multi-function jackets, for example, accounted for a major share of sales in 2024 and continue to grow rapidly in 2025.

Key product features such as windproofing, waterproofing, breathability and sun protection are driving purchase decisions. Equally important is reassurance around use cases—whether for travel, hiking, or mountaineering. For brands, the implication is clear: superior and innovative products, marketed on their technical merits, will outperform purely emotional campaigns.

Image: Sun protection plays a key role in outdoor apparel but has declined with jackets growing rapidly

Data from our China Outdoor Apparel: 2024-25 Ecomm Report

3. The Critical Role of Offline Activation

Community-building is a defining feature of successful outdoor brands in China. Unlike other sporting goods categories, outdoor activities are inherently social—friends and families can bond through a simple walk or hike.

The most effective brands are actively facilitating these activities, creating meaningful offline communities that reinforce their product positioning. Coupled with distinctive product offerings, this strategy is proving highly effective in building long-term customer loyalty.

Image: Brand investment in offline presence & community building is supporting online growth

What’s Next for Outdoor Brands in China?

The outdoor market is at a pivotal moment: broad consumer enthusiasm, demand for technical performance, and the importance of community engagement are converging to create a unique growth opportunity. Brands that focus on innovation, education, and authentic connection will be best placed to capture long-term market share.

Looking to strengthen your strategic approach to China? Contact the Hot Pot team at nihao@hotpotchina.com to book a consultation today.

China Outdoor Apparel:

2024-25 Ecomm Report

In partnership with Sporting Goods Intelligence Europe and Outdoor Industry Compass, this report offers a deep dive into the fast-growing outdoor apparel market in China.

Explore platform trends, product focus, brand performance and pricing insights across Tmall, JD.com and Douyin.

Download now to unlock exclusive insights into China’s outdoor apparel market and how your brand can stay ahead.

Have you checked out our ebook deconstructing success in China for the fitness market? Discover real data, proven strategies and expert insights to help brands unlock growth in China with our interactive ebook.

Related blog posts